Groups 2 & 3: Lessons from Group 1 Australian climate disclosure programs

6 min read 13 July 2025

As the first to report under Australia’s mandatory climate disclosure regime, Group 1 entities are deep into the process. Their experience offers valuable insight into how Groups 2 and 3 should be approaching their own journeys.

This practical Q&A shares what we have learned working to support our Group 1 clients over the last few years.

How long does it take?

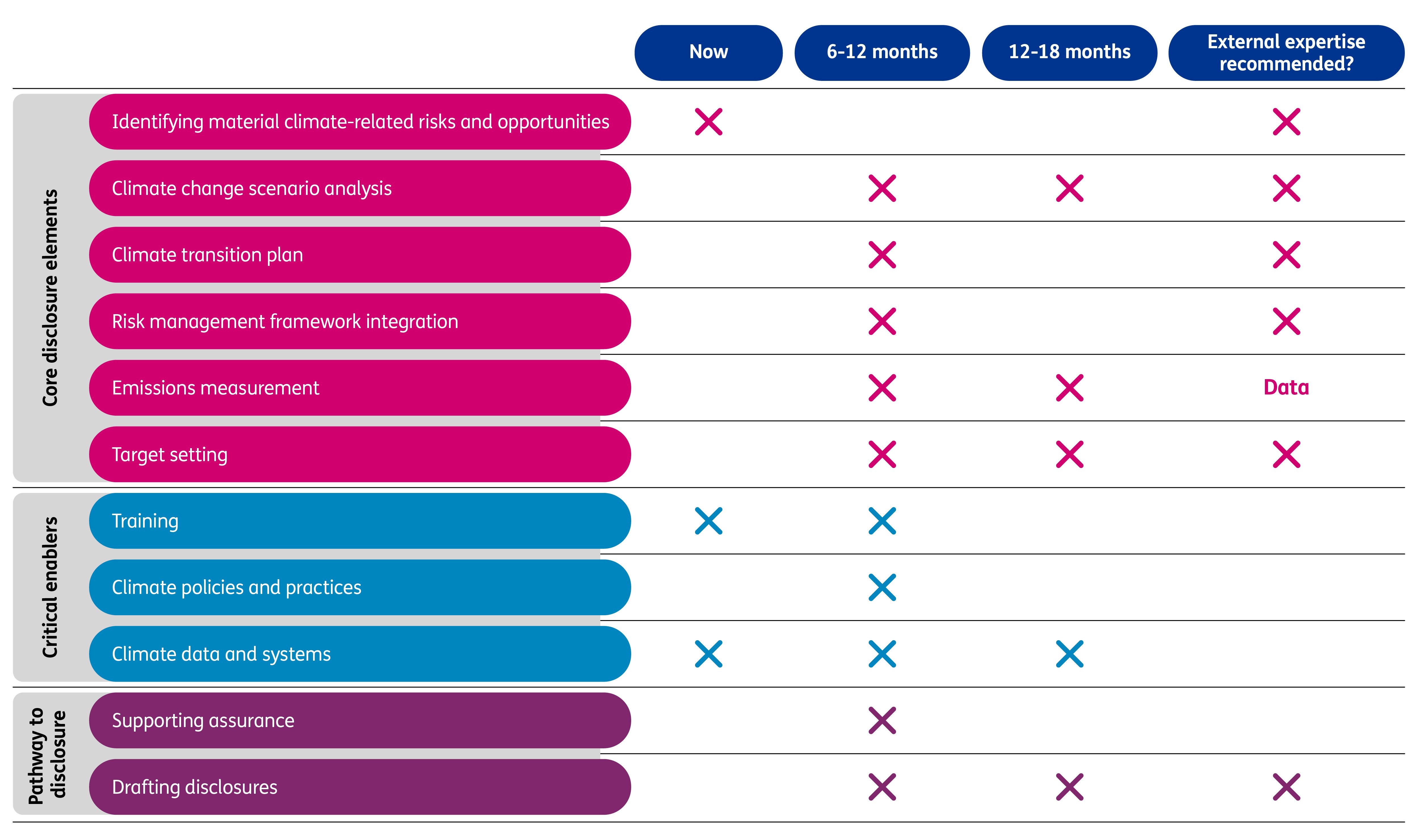

A good 12 months – at least. You can see what’s required and the likely timeframes in the table below. It’s not just about setting up and managing an effective climate disclosure program; it’s also about integrating your climate impacts into your strategy and decision making.

Source: Baringa

How much technical knowledge do we need?

Climate experts can help with the detail and tricky technical bits, but you know your business best.

You’ll be putting a climate lens over your traditional risks and business strategies. That means deciding what climate risks and opportunities might affect your cash flows, your access to finance or your cost of capital – and quantifying the possible impacts. You already have a lot of the knowledge and capabilities needed to do this in your organisation.

For example, the starting point is working with your Finance team to understand the underlying drivers of profitability and balance sheet changes. Then you’ll likely need a climate expert to help you identify the physical and transition risks and opportunities for your business model and strategy, under different scenarios.

Next, your climate expert will work with Risk, who’ll look at the likelihood and impact of these risks at a line-item level. Now Risk can quantify the impact on financial drivers under each scenario and set conditions for what qualifies as ‘material’. Finally, Strategy can decide which potential climate opportunities are worth building into your long-term strategy.

When we went through this process with a payments provider, it took about six weeks. Be aware that your board will likely take the same length of time of time to sign off on what the business has come up with.

What if the board challenges the risks?

Make sure you have a clear rationale – with an audit trail – for why a decision has been made. And that the person ultimately accountable is aware of what’s happening and comfortable with where you’ve landed with the risk framework.

How much will our risk universe change?

At first, not very much. Group 2 and 3 companies generally find climate is dwarfed by other risks. That said, some transition scenarios – say, if Australia sets a carbon price – will create major economic disruptions that could materially affect your business. You need to understand what the big tickets items will mean.

On that point, what is a good audit preparation tip?

Put all your evidence in one place or folder and hand it over. This makes the audit process significantly easier and less burdensome on your teams.

Where should we start?

Executing a few key workstreams well can help build confidence in the overall program. A good place to start is with business-wide qualitative scenario analysis. This helps identify the most important risks and opportunities tied to financial outcomes. It also quickly brings clarity and direction to other important areas like risk planning, transition strategies and financial management.

How can we avoid being overwhelmed?

Don’t overcomplicate it. But, equally, don’t underestimate the time it’s going to take.

You already have a capable team with a strong understanding of your financials and business drivers. With a pragmatic approach and the help of a climate specialist adviser, you can turn climate disclosure into something genuinely valuable – a way to sharpen your business strategy, clarify your financial exposure and future-proof your operating model.

Remember: disclosure is a byproduct of great business planning and insightful strategy. Think of the capabilities you need, then the biggest questions your business needs to solve. Now you’re in a position to understand the best way to disclose. Going through that process will help you uncover capability to look at – and commercialise – your understanding of a range of stressors. That’s when you can be confident your disclosure is credible and well-evidenced.

Where can I find out more?

Baringa offers a range of practical tools and insights to help you deliver climate disclosure programs appropriate for your organisation.

Whether you're just getting started or exploring the latest developments, check out our insights on delivering tailored Australian climate disclosure programs here.

Our Experts

Related Insights

Organisational agility: a guide to taking the first steps

Our business agility and operational excellence expert Simon Tarbett offers some advice to clients when asked the question, Where To Start?

Read more

The need for agility to grow revenue and thrive in a turbulent market

We’re looking at how organisations need to be agile if they’re to grow revenue and thrive in a turbulent market.

Read more

How to set targets to drive business performance

Targets are essential for driving better business results. Let’s discuss what companies should – and shouldn’t – be doing.

Read more

How frozen organisations can become fluid

To develop organisational agility, focus on being like water.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?