Why customer engagement is the next frontier in financial services

6 min read 22 April 2025

In the financial services sector, the metrics that matter are changing. While institutions obsess over net interest margins and cost-to-income ratios, they're missing what might be their most valuable asset: customer loyalty. This isn't just another KPI—it's the difference between thriving and merely surviving in today's digital ecosystem.

The harsh reality? Most financial institutions don't have customers—they have account holders. People tap their debit cards, pay their insurance premiums, and check balances without feeling the slightest emotional connection to the brand behind these services. They're transacting, not engaging. This transactional relationship leaves institutions vulnerable in an age where switching providers is as simple as a few taps on a smartphone.

True customer loyalty transcends simple usage metrics. It manifests in meaningful digital interactions that go beyond the obligatory monthly account check. When customers regularly engage with your digital platforms because they want to—not because they have to—you've unlocked the secret to sustainable growth.

So, how can you excel in customer engagement and drive lifelong customer financial loyalty? We believe success depends on five key areas:

1. Make your mobile app your primary channel

Mobile has become the norm in financial services, with three in five UK adults now using mobile banking apps.1 It's not just banks that are leading the way, tech-focused players like Lemonade and esure are embracing digital and shaking up the insurance market.

But digital channels aren’t a magic bullet. The experience still has to be seamless. Journeys that start in the app and end on a webpage don’t deliver great experiences and end-to-end customer journeys delivered through mobile experiences must become a top priority.

The data backs this up:

- Banks with superior mobile experiences show 12% higher return on equity.2

- Banks with highly-rated mobile apps experienced 36% higher deposit growth over a three-year period.3

- Insurers that deliver better customer experiences outperformed their peers in total shareholder return by 20% for life insurers and 65% for property and casualty insurers over a five-year period.4

When it comes to crafting great app experiences, onboarding is a key area to focus on as it leaves a strong first impression. Get onboarding and authentication right, and the customer is likely to stay with you for the long term, exploring other financial products. But get it wrong, and they might drop out of the process early. In fact, a global study of over 450 c-level executives across corporate, institutional, and commercial banks found that more than two-thirds (67%) have lost clients due to slow and inefficient client onboarding and KYC.5

Once onboarding is complete, the positive experience needs to continue with an app that’s intuitive, personalised, useful, and works well. A good app can fast become customers’ go-to channel for interacting with a financial services provider. But a bad app simply won’t get used. In fact, 80-90% of apps are deleted after being used once,6 and the average smartphone user uses only 38% of their apps at least once a month.7

2. Provide products that meet customer needs

A great mobile app works wonders for building loyalty. But if you don’t have the range of products to meet customers’ needs, they’ll have no choice but to go elsewhere.

Several financial services companies have found themselves in this predicament and have had to diversify their portfolio to stay competitive. After building its business on debit cards, Monzo for example, has significantly expanded its offering to include pensions, investment products, and a buy-now-pay-later offering to rival Klarna. Similarly, many insurers are extending their portfolios—through both product launches and partnerships—to provide broader coverage. For instance, esure’s partnerships with InsurTech RightIndem and mapping specialist HERE Technologies have fueled improvements in customer metrics such as a 58% to 83% increase in ‘renewal ease’.8

It's important to provide a consistent, recognisable experience across all offerings, even if some are from third parties. Larger financial services providers usually have the full range of products that customers need, but they don’t necessarily live up to expectations around customer experience. Newer market entrants often excel on customer experience, but they lose out on potential business when people want financial products that they don’t offer.

3. Personalise your products and services

The best way to earn loyalty is by truly solving customers’ problems. In financial services, this means gathering relevant data about customers and using these insights to meet customers’ needs by recommending relevant products and services.

For example, if you know that a customer recently bought a house based on mortgage data, you could offer them a loan for home renovations and use salary data to calculate a pre-approved loan value. The right data and back-end technology can translate into fantastic, tailored customer experiences.

Personalisation has driven the roaring success of Nubank, which has expanded rapidly to become the world’s largest digital bank.9 Nubank’s app, for example, provides daily suggestions—such as payment reminders or new product offerings—based on individual user behaviour to help personal finance management. With customer numbers up 23% year-on-year, it now serves over 110 million people—80% of whom were acquired through word of mouth, delivering personalised recommendations in its app home screen to customers.10, 11

Nubank-style advocacy is rare in the UK, but some consumers here feel a similarly strong bond to tech-driven financial institutions like Monzo and Starling, which provide delightful experiences to solve specific customer pain points. In other words, there’s potential for customer advocacy in the UK financial services market—but most providers haven’t managed to access it.

4. Deliver delightful experiences

The customer experience should sit at the heart of everything you do, because it drives engagement and loyalty. But too often, it falls by the wayside.

Let’s take the onboarding example again. Finance is inherently an emotional subject, particularly as many UK consumers struggle with the increased cost of living. However, some financial institutions present prospective customers with long onboarding questionnaires and authentication processes, which are tedious at best, stressful at worst and often not proportional to the customer need. Some banks enable people to open accounts in just 24 clicks, but with others, it can take 120 clicks—five times as many.12

When it comes to onboarding, the top priorities are:

- Getting people onboarded quickly and digitally

- Using third-party services to authenticate customers instantly, without asking too many questions

- Letting customers use products straightaway, then only requesting further information when customers want additional products.

In other words, it’s important to put friction in places where it’s proportional to the task and the risk, such as authentication to enter the app.

Another area to focus on is supporting customers’ financial wellbeing. For example, Monzo has won acclaim for its “1p savings challenge”, designed to help people with no experience of saving to build good financial habits, with Money Saving Expert site calling it “a clever, fun and relatively painless way to amass a surprising sum.”13

5. Focus on metrics that matter

In other industries like social media, customer engagement is an established metric, measured in units such as likes, comments, shares, and followers. But financial services is another world altogether, and measuring engagement here demands a different approach.

It’s important to select metrics that measure the quality of customer interactions. For example, time spent on the app isn’t necessarily a good indicator of positive engagement, because it might mean that customers are struggling to do what they need to do due to a poor user interface. Meanwhile, traditional metrics—such as transaction frequency or email open rates—only capture activity, whereas true engagement is multi-dimensional.

We believe it’s important to build metrics around a framework that allows you to understand whether customers:

- Believe you help them achieve their financial goals

- Enjoy interactions with you

- Would buy other products from you

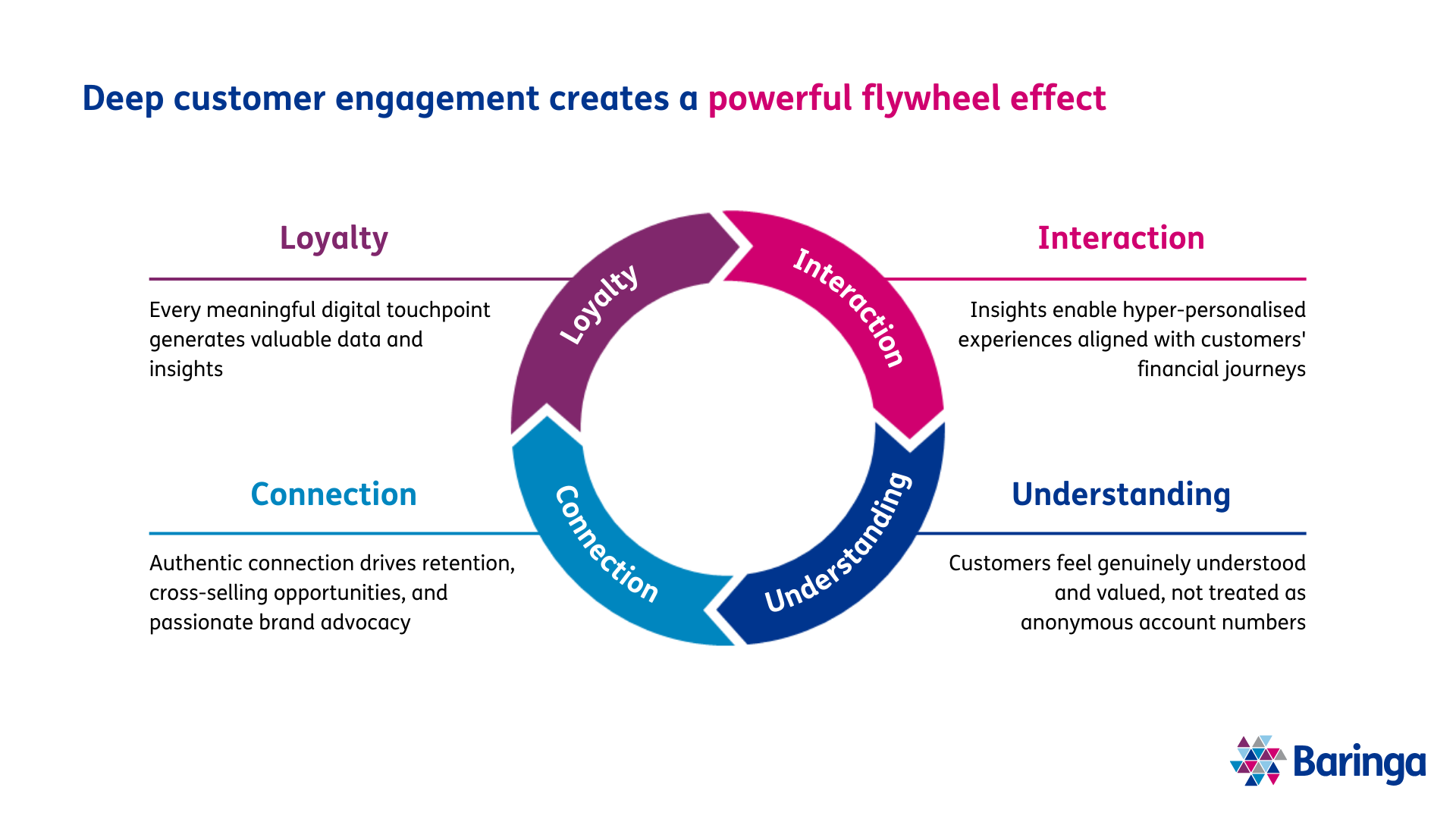

Turn engagement into your competitive differentiator

A broad, relationship-centric model of customer engagement isn’t a nice-to-have, it’s survival. By transforming complex data on customer interactions into actionable strategies, you can improve customer experiences and build deep, meaningful relationships and earn loyalty that’ll generate rewards for years to come.

Interested? If you’d like to discuss the topics raised in this article and hear more about how we can help—including through our customer engagement framework—please get in touch.

---

1 Digital banking statistics 2025: How many Brits use online banking?

2 S&P Global Market Intelligence newsletter

3 S&P Global Market Intelligence mobile banking adoption analysis

4 Elevating customer experience: A win-win for insurers and customers

5 Share of banks losing clients to poor KYC practices surges to record high

6 A guide to user onboarding techniques for mobile apps

7 Mobile app download statistics & usage statistics (2025)

8 esure Group annual report and accounts 2024

9 Nubank consolidates as world’s largest digital bank

10 Nubank consolidates as world’s largest digital bank

11 Building a global product powerhouse

13 How to save £667.95 in 2025 with the 1p Savings Challenge

Related Insights

Why customer loyalty determines the success of bank M&A

Why customer loyalty determines the success of bank M&A

Read more

Baringa insurance survey: win loyalty where others fail

Insurers risk losing loyalty as digital expectations soar. Discover why legacy systems block progress and how to win customers back.

Read more

10 tech trends reshaping financial services in 2026

We explore ten interconnected themes that will define success in 2026 and beyond—covering how firms can modernise architecture, embed AI responsibly, strengthen resilience, and optimise technology investment.

Read more

Baringa retail banking survey: legacy tech, lost loyalty

Legacy tech is eroding customer loyalty. Discover why over a third of customers switched banks, and what leaders must do to close the digital experience gap.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?