Power procurement imperative: act now or pay later?

5 min read 10 July 2025

The PPA market has boomed in recent years with a record 46 GW in 2023 driven largely by strong growth across EMEA and APAC. In 2024, the US market grew a further 26%.

Corporates and large energy users are rethinking their power procurement strategies, and the first and most significant step they consider is entering into Power Purchase Agreements (PPAs). Several factors drive this trend. The energy crisis of 2022 highlighted the importance of cost stability, proving that short-term, two to three-year hedges are insufficient for managing costs. Carbon reduction commitments, including pledges to cut emissions by a specific percentage by a given target date, have transformed the way energy users approach procurement.

While PPAs have become an important strategy for many energy users, they should not be the sole approach. Depending on your business's unique needs, procurement strategies that manage both cost and carbon encompass behind-the-meter (BtM) generation, electrification, demand-side response, and other initiatives. These strategies coexist alongside traditional hedges, which still play a role over the liquid horizon.

Why is the market getting more complex?

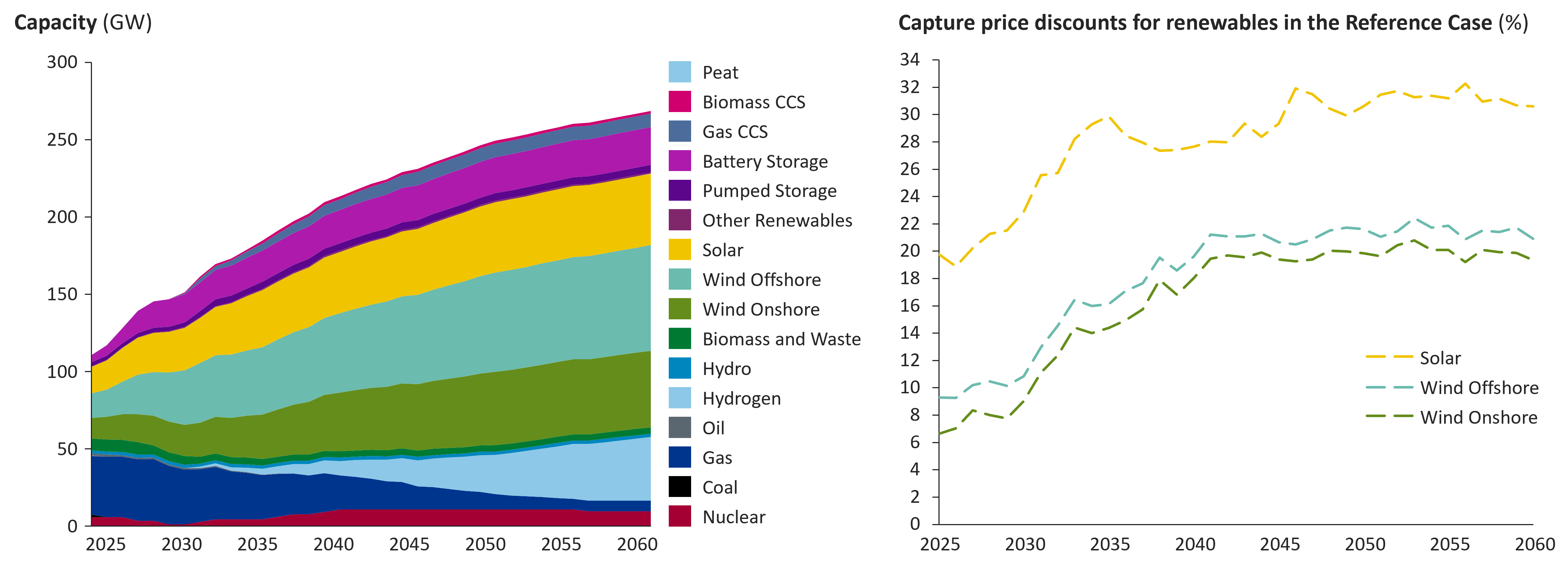

The introduction of new long-term procurement strategies involving renewable PPAs with intermittent generation, has added complexity to traditional approaches. The challenge of managing the intermittency inherent in solar and wind power, introduces shaped generation into the demand profile, which in turn incurs additional shape- and intermittency- management costs. Shaped generation refers to the variable hourly output of renewables, driven by changing wind and solar availability, which cannot be controlled. As the penetration of renewables increases, so does the cost of managing this intermittency. In the UK, for example, we project solar and wind capacity to grow by less than 50% by 2030. Consequently, the cost of managing shape as a percentage of wholesale prices is expected to increase accordingly by around 30%.

|

Baringa projects the share of solar and wind capacity to increase 2030, with shaping costs increasing further

As renewable exposure within a demand portfolio grows, so too does the responsibility of managing these associated costs. Moreover, aligning the demand profile with generation assets becomes increasingly crucial for cost management. If BtM generation is added, altering the volume and shape of demand, alongside grid-connected renewables, the resultant demand shape differs from what it would be under a traditional hedging approach.

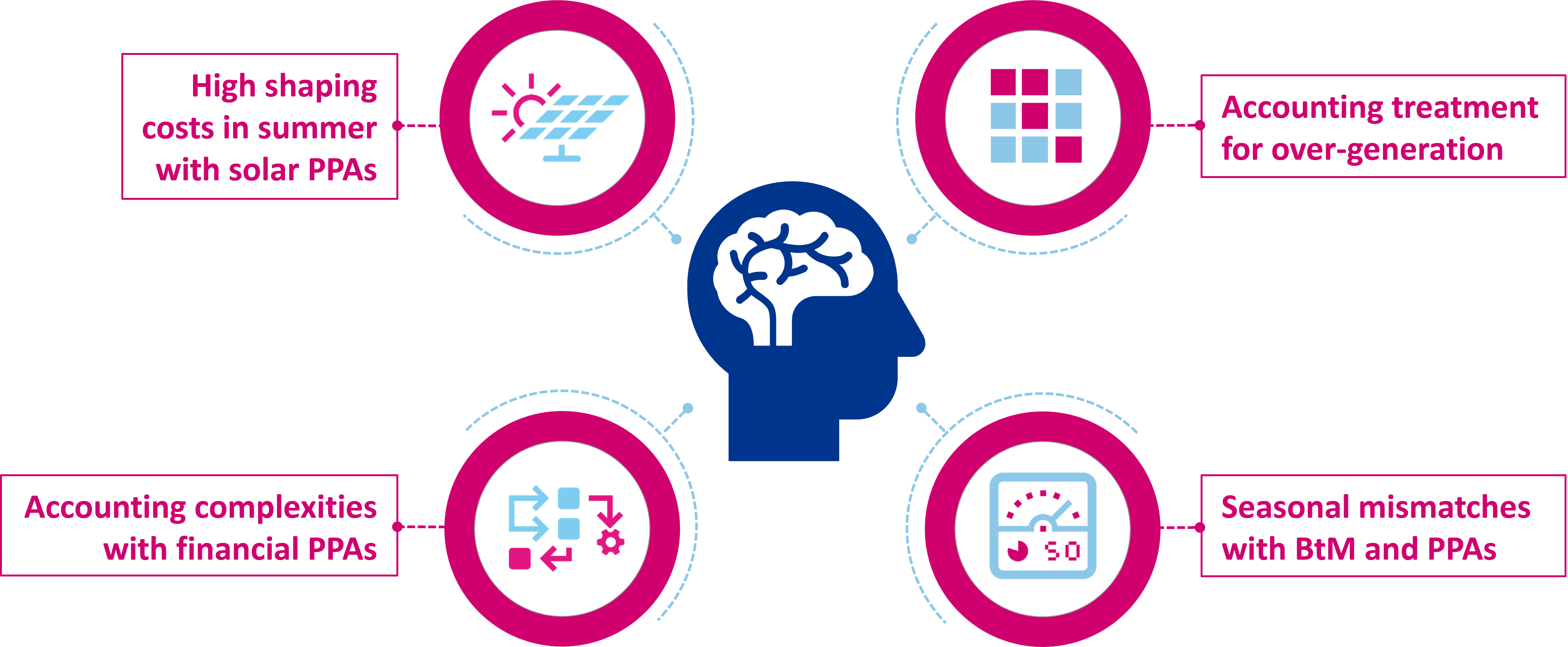

We have observed a range of challenges in this evolving landscape:

- Companies who have signed multiple solar physical PPAs often face high shaping costs during summer months due to the peaky demand shape

- Those who entered into financial PPAs a few years ago are now encountering accounting complexities they had not anticipated. Some companies, for instance, are unsure what data to use for audit purposes since the liquid horizon does not cover the full PPA tenor

- Many opted for physical PPAs to avoid accounting treatments, only to find that generation exceeding their demand will trigger additional accounting requirements

- For some companies, BtM solar generation combined with a balanced PPA portfolio of solar and wind lead to seasonal mismatches, overhedged in summer and underhedged in winter

Hidden costs and unanticipated risks: practical lessons from navigating the evolving procurement landscape

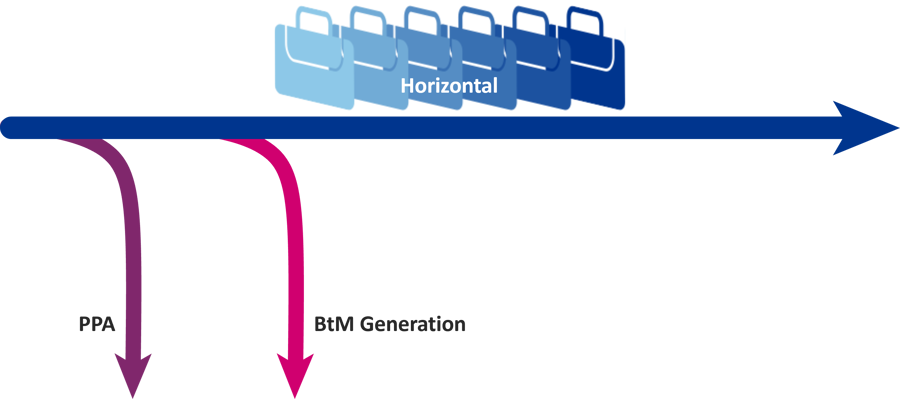

These additional complexities, born of modern procurement, highlight the need for a strategic shift. Power is no longer solely a Procurement exercise and responsibility, but rather a Board-level agenda item - to ensure the right balance between cost, risk and a credible power strategy. Today’s procurement landscape no longer allows for isolated assessments. Instead, businesses need a holistic view that integrates two types of approach to strategy: Vertical and Horizontal.

The vertical approach entails detailed scrutiny of each individual PPA contract or BtM asset. This involves examining cost implications, understanding how the strategy aligns with carbon reduction targets, and assessing potential risks such as the interplay between commodity prices and low weather output years. This analytical and strategic depth must precede, accompany, and follow procurement actions to ensure proactive management.

Equally important is the horizontal approach, which examines how each element of a procurement strategy interacts with others. For example, when combining hedges, BtM, PPAs, and electrification within a single portfolio, it is essential to evaluate overall performance. A portfolio heavily weighted toward solar generation may yield high output in summer, necessitating a careful hedging strategy to avoid being overhedged in a market condition that is seeing low power prices due to high solar generation.

Modern procurement demands both vertical depth in contract analysis and horizontal integration across portfolios

Implementing these dual strategies, vertical and horizontal, introduces several challenges:

- Fragmented Data: The decisions around each part of the strategy sit with different teams across finance, procurement, and sustainability, often working in isolation. These teams might be spread across different geographies or even have dedicated teams per region focusing on demand procurement in isolation. This fragmentation often results in inconsistencies in the methodologies and data used for analysis, making financial performance metrics less reflective of true outcomes and more indicative of discrepancies in data sources and analytical approaches.

- Complex Reporting Requirements: How each strategy performs needs to be communicated effectively to relevant stakeholders. CFOs want to understand the finances, CEOs want to see the full strategy, and sustainability teams need to track sustainability commitments. However, with strategies, contracts, assets, and hedges spread across different teams and various excel spreadsheets , providing clear and consistent reporting is a significant challenge.

- Limited Portfolio-wide Analytics: Another challenge is consolidating a comprehensive view to demonstrate overall performance. Because data, analysis, and decisions are often stored separately, it is difficult to provide a portfolio-wide view that allows for holistic risk exposure assessments.

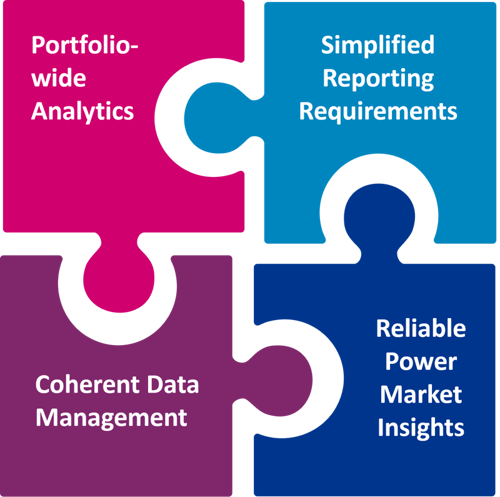

These challenges highlight the need for more cohesive and centralised platforms that can bridge the gap between teams, streamline reporting, and enhance visibility across portfolios.

The need for energy market insights is becoming increasingly critical. Traditional spreadsheets and disconnected tools struggle to capture market dynamics, pushing companies to seek integrated solutions that provide deeper visibility into procurement strategies and power markets. To overcome these challenges, businesses must transition from static data management to platforms that streamline risk assessment and support smarter, data-driven decision-making in a world where power markets continuously evolve and change, making constant adaptability a must.

The stakes are high. The companies that navigate this complexity effectively are not just avoiding risk, they are seizing an opportunity to lead in the energy transition. This is about more than just compliance or cost-cutting; it’s about gaining a competitive edge in a market where sustainability and resilience are no longer just aspirations, they are expectations. Expectations in place from all corporate stakeholders.

To thrive, businesses must shift from reactive, siloed strategies to proactive, integrated procurement. This means embracing data-driven decision-making that aligns procurement strategies with long-term sustainability goals, carbon reduction commitments, and cost resilience. If you achieve this, you will not only mitigate risks but also unlock new value streams, optimise your portfolios for both cost efficiency and environmental impact, and position yourself as a leader in the clean energy economy. The pathway is clear: define renewable energy targets, understand your risk tolerance, and deploy advanced platforms that provide actionable insights. In this new era of energy procurement, success will belong to those who can think holistically, act proactively, and adapt swiftly to market dynamics. The time to make that pivotal transition is now.

Energy Source | Manage your power position

The only investment-grade software for your energy strategy, execution and risk management.

Read more"This is about more than just compliance or cost-cutting; it’s about gaining a competitive edge in a market where sustainability and resilience are no longer just aspirations, they are expectations. Expectations in place from all corporate stakeholders."

Reyhaneh Aboutalebi, Expert in energy portfolios and risk

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?