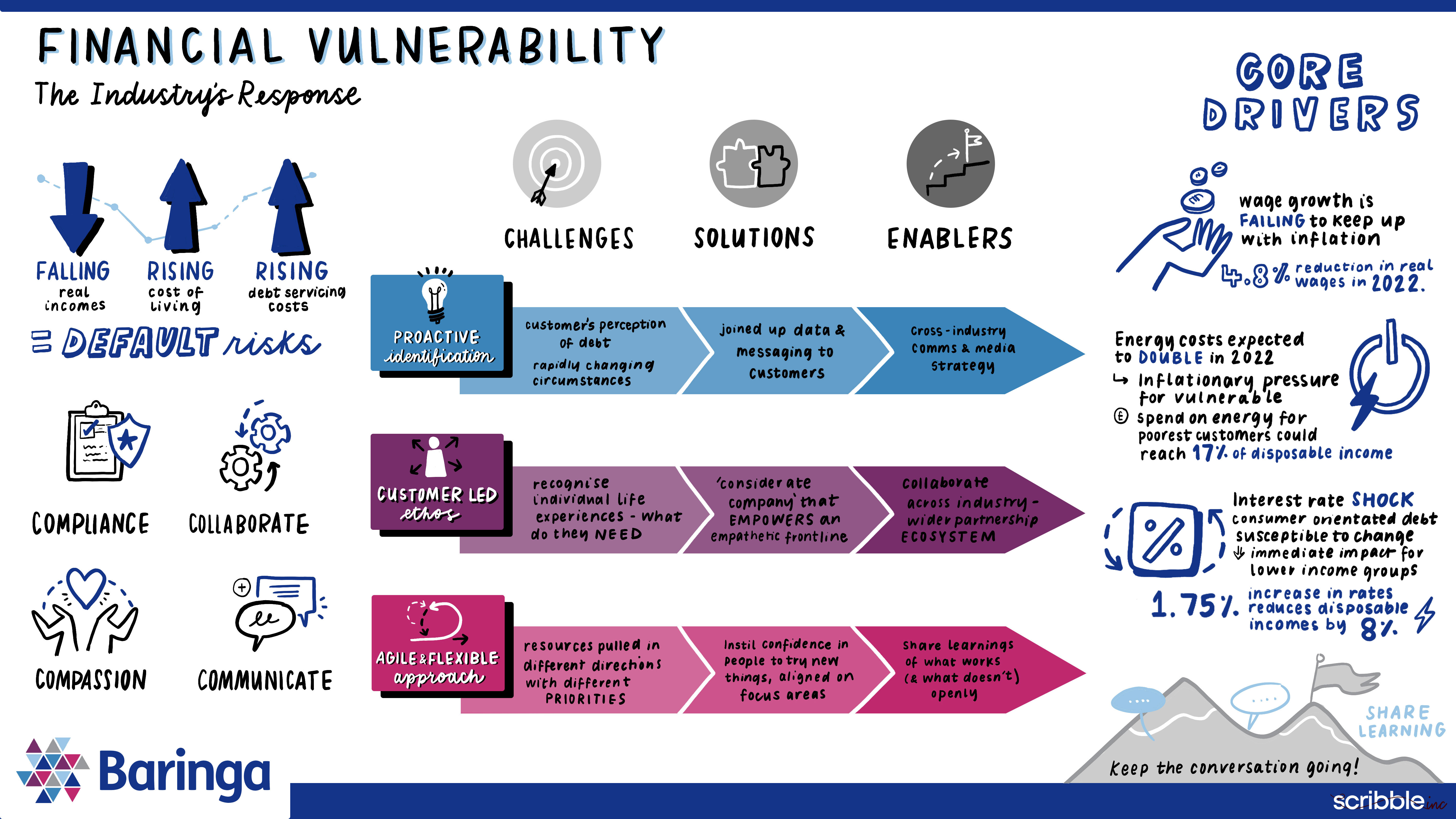

What do businesses see as the biggest challenges of this Cost-of-Living crisis? What can they do to best support their customers? What tools do they need to be successful? These are the questions we asked during our cross-industry round table and client interviews, focused on addressing the challenge of growing financial vulnerability of UK customers.

Building on our Financial Vulnerability campaign, we have heard from industry leaders across energy, water, customer focused charities and providers, that together represent 80% of UK Households’ utilities providers.

In this article, we share an overview of the perceived challenges, solutions and key success factors highlighted by our clients and industry partners around the topic of financial vulnerability. Quotes taken from the round table discussion are not attributed to any specific individual or organisation, as agreed by participants.

Our hope is that themes shared here influence the ongoing conversation on this pressing topic throughout 2022 and beyond.

A rapidly deteriorating economic situation that is already impacting customers

The UK is facing the worst economic situation in our lifetimes. The average family faces at least a £2000 hike in annual bills, with Baringa analysis suggesting a 1.75% interest rate increase could reduce disposable incomes by 8% for the poorest in society. We discussed that financial vulnerability is now a very real feature of customer’s lives; borrowings are “jumping back up”, indicating that the COVID-19 savings piggy bank is emptying, and the number of pay day loans being taken to cover energy bills is increasing. Businesses must be aware of the risks:

- Self-rationing: Customers may be self-rationing as a function of distress, not energy efficiency.

- Emotional Distress: As economic pressures add to the toll on customers, increasing numbers of people are referencing suicide and violence to both organisations and charities (Christians Against Poverty have seen a marked increase in clients reporting suicidal thoughts).

Our round table was focused on the theme of how businesses can be part of the solution to financial vulnerability, exploring the challenges, solutions, and wider factors that will enable success.

PART ONE: Proactive identification of customers in, or at risk of, financial vulnerability

"It’s important to start using the tools that are available, speech analytics; service by design, tools that enable organisations to identify vulnerability."

Helen Lord, CEO, Vulnerability Registration Service

PART TWO: A customer-led ethos to develop propositions and support mechanisms

"We are now seeing a greater polarisation between those of us that can afford to actually pay for better levels of service and those that cannot."

The outlook for customers in 2022 - Jo Causon, CEO, Institute of Customer Services

PART THREE: Agile and flexible response to rapidly changing circumstances

"We see people that will struggle for the first time; we are looking at affordability options for them such as payment breaks, data sharing with customers on payment credits and flexible payment plans."

The financial vulnerability challenge facing customers - Katy Taylor, COO, Southern Water

What's next?

The financial vulnerability round table demonstrated a level of cross-company and cross-sector collaboration that will be one of the key ingredients to success as we look ahead to a challenging 2022:

- No one wins where debt is concerned: it is bad for society and bad for business.

- “Considerate Companies” that take a customer-centric approach will emerge as winners in race for customer loyalty.

- There is no “silver-bullet” solution to the challenges we face, there are many small, incremental improvements to be made

How are you supporting your customers through the cost-of-living crisis? Contact one of our experts to join the ongoing cross-sector discussion and work together to be part of the solution.

Our Experts

Related Insights

Britain’s poorest face doubling of debt to energy suppliers

According to Baringa's figures, Britain’s poorest people now owe twice as much to energy suppliers as they did during the 2022 energy crisis.

Read more

Taking a person-centred approach to managing financial vulnerability

As Australia starts to feel the impact of rising energy bills, we share our view.

Read more

Safeguarding Financial Vulnerability

Growing numbers of customers, and businesses, are more financially vulnerable than ever.

Read more

Financial vulnerability – industry insights

We’ve been speaking with industry experts to gain their insights into the financial vulnerability challenges facing business and customers.

Read more