Commodities traders are starting to engage in carbon trading. This is a response to growing pressure from investors, but it is also an opportunity to offer new services to customers and to participate in increasingly liquid markets.

One unintended consequence of the pandemic is that long-established trends have been accelerated and carbon markets are no exception. Carbon trading has seen enormous growth in the last year – in both compliance and voluntary markets.

Refinitiv, a market expert, estimates that the global value of compliance carbon markets grew by almost 20% in 2020, reaching a total value of €229 billion, with a traded volume of over 10 billion tonnes of carbon. Driven by tighter government controls, ripe market conditions and increasing participation of hedge funds and other market players, the price of emitting a tonne of carbon dioxide has risen to a record high. In the EU Emissions Trading System (ETS), the closing price of European carbon allowances (EUA) reached €60 a ton over the summer, more than triple the average price in 2018.

Voluntary carbon markets have also grown considerably in the last year (around 90 million tonnes in 2020) but are set to experience exponential growth thanks to the rapid proliferation of net-zero carbon commitments by major corporations. The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) estimates that the market for voluntary carbon credits could be worth upward of $50 billion in 2030. Despite the absence of national-level carbon pricing schemes, we are seeing the emergence of intertwined and standardised carbon pricing and purchasing efforts. The growth of this market is dependent on the development of strong project finance foundations, where contractual obligations, operational execution, price and volume certainty are clearly understood, making it possible to attract both customers and financiers.

Why are traders entering this market?

Since the beginning of 2020, we have seen an increase in participation of traders across both voluntary and compliance carbon markets. There are three main reasons for this recent engagement:

- Traders are coming under pressure from shareholders, regulators and external investors to reduce the emissions intensity of their supply chains.

- Traders are uniquely positioned to offer carbon offsetting as a service. Traders’ experience in pricing commodities and project finance could be leveraged to guarantee that offsets have the impacts expected by large corporate buyers and to bundle certificates together with the supply of commodities.

- As active market participants, traders can develop a great understanding of both compulsory and voluntary markets, which will make it possible to profit from unique proprietary trading opportunities in both markets.

How are traders participating in this market?

Offsetting emissions

Commodities traders are coming under pressure from shareholders, regulators and external investors to reduce their own carbon emissions. The pressure to tackle emissions originates from banks looking to reduce the emissions intensity of their financed portfolios, as well as customers, who see procurement of greener commodities as a necessary tool to achieve their emission reduction targets. Importantly, traders can no longer limit their emissions reporting to emissions generated directly through their own activities (Scope 1 and 2) but must include those originating from production, transportation and the eventual consumption of traded goods or services (Scope 3).

The most obvious role of carbon trading is as a mechanism to offset those emissions that are difficult to reduce or remove. Purchasing voluntary carbon credits allows traders to negate the emissions they produce by financing the avoidance, reduction or removal of carbon from other sources, such as by investing in renewables or sequestration projects. The key to do this most effectively is to understand what constitutes a valid offset. Despite the lack of global carbon pricing schemes, we are seeing the emergence of approved standards (VCS, Gold Standard, ACR) which provide assurance that the carbon reduction associated with credits is real and verified.

If voluntary offsets need to become standardised, so do the ways in which commodities traders track and report their emissions. Scope 3 emissions are notoriously difficult to account for, and firms will need to establish clear accounting principles to demonstrate to investors how they measure and offset the right amount of carbon. Typically, the emissions of a given trade are generalised across different types of vessels, fuel, routes and other factors but to convince investors, traders will need to do more. This is the value of tools such as CarbonChain, which allows firms to accurately calculate emissions on a trade-by-trade basis. Accurate carbon calculation also offers an opportunity for traders to optimise their portfolio based on carbon data and further reduce their emissions.

Offering services

Knowing the carbon footprint of a trade is not only vital for traders but also for their customers who are looking to reduce their carbon impact. For them, the transportation of a commodity is part of their Scope 3 emissions and knowing the carbon intensity of a trade is therefore valuable.

Carbon trading is thus not just a method for traders to offset emissions, but also an opportunity to offer new services to customers. At the most basic level, commodities traders can use carbon credits to offer customers carbon neutrality on their products, selling an offset as a fee included with the cargo. At scale, this offers huge value to traders who have accumulated large quantities of offsets (or offset-generating projects) and can offer them in parcels to customers on a trade-by-trade level.

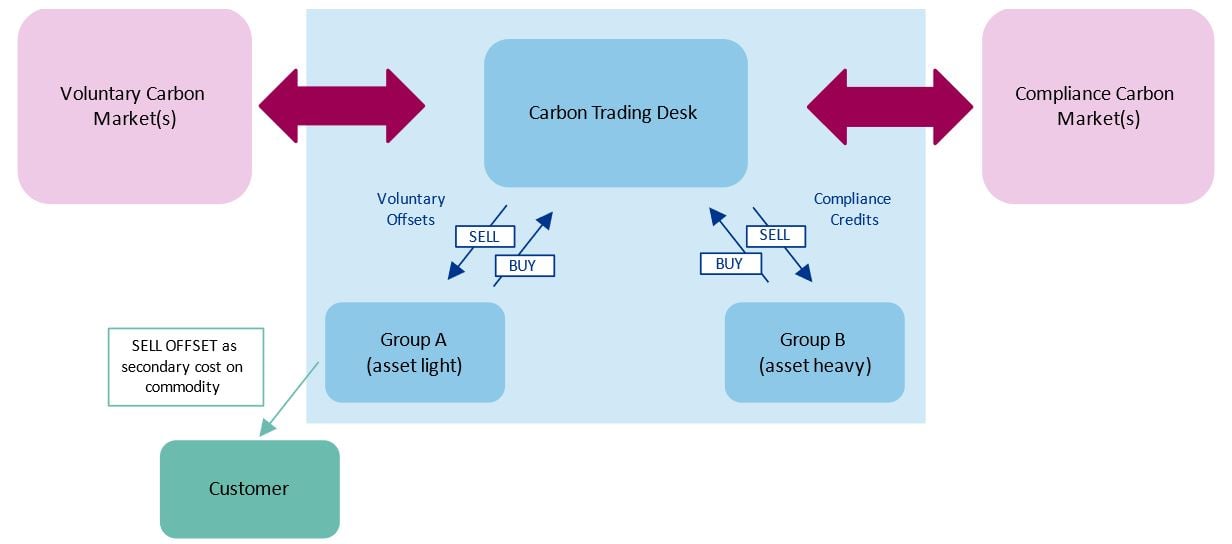

In the long term, traders should establish centralised carbon desks to help define their carbon strategy, monitor their carbon intensity and hedge their exposure to emissions by trading in voluntary and compliance markets - in much the same way that FX functions help traders reduce the risks assigned to currencies. Combining this with accurate emissions reporting tools will not only allow trading firms to efficiently manage assets operating within carbon regulatory boundaries but also provide the data needed for traders to start accurately pricing carbon and generate new sources of revenue.

Basis trading

Finally, carbon trading by itself is an opportunity for traders. The recent high prices in the EU ETS are no surprise – they are a response to speculation in an increasingly liquid and high-demand market.

Historically, the ETS has relied on regulation, using a ‘cap and trade’ system to force installations to pay a premium for the carbon they produce. However, the recent growth in price is not driven by regulation alone but also by speculative trading from third parties looking to make gains off a market destined to grow. In particular, large-scale investors such as hedge funds have increased their trading activities, seeing misalignment between current carbon prices and national carbon-neutrality pledges.

The same is true in voluntary carbon markets, which have already seen a 60% increase in market value from last year, largely driven by an increase in speculators purchasing credits. The average price per ton ($3-5t/CO2e) remains considerably lower than the equivalent in compliance markets but this gap will narrow over the course of the next decade, with demand for carbon credits expected to increase five to ten-fold as more companies adopt net zero climate commitments. Speculation in both types of carbon markets is destined to become more widely spread, increasing price visibility and liquidity, and ultimately creating opportunities for traders to profit from market volatility in this critical commodity.

How can Baringa support traders to enter and participate in the carbon markets?

Baringa has vast experience and a proven track record of project delivery across the commodities, energy and carbon sectors and a team who understand the language of commodities businesses. We believe that traders should build a comprehensive view on carbon strategy and net zero ambition and make carbon trading part of an ambition to become a long-term sustainable business. The path for traders to develop this comprehensive view includes:

- Promoting deep understanding of carbon in the business - Understand the carbon manifestation in the business, analyse short- and long-term impact to the organisation, identify levers to build a net zero organisation.

- Enhancing current operating model - Leverage current capabilities to play in new markets, and develop new skills and expertise to embed carbon management in the organization

- Developing new business opportunities - enter emissions trading markets, analyse and quantify emissions intensities and assess the impact of new policies and regulations.

Baringa stands ready to help companies navigate that path.

If you want to know more about the topic or discuss what the challenges raised by this blog mean to your business, reach out to the authors:

Tibor Horvath, Senior Manager

David Kane, Partner

Christian Lindsay, Analyst

Related Insights

The future of European CfDs

Contracts for Difference have been successful at increasing competition, accelerating capability buildout and stabilising prices in many European states.

Read more

Asian LNG markets: evolution and growth in response to the war in Ukraine

The rapid reduction in Russian gas exports to Europe has resulted in an unprecedented reshuffling of LNG trade dynamics.

Read more

Commercial fleet electrification – adoption is accelerating, but barriers remain

With 50% of new car registrations in the UK being registered by businesses, it’s vital for companies to start electrifying their fleets.

Read more

2040 Global Gas Market Outlook

Opportunities for investors to contribute to the energy transition.

Read more