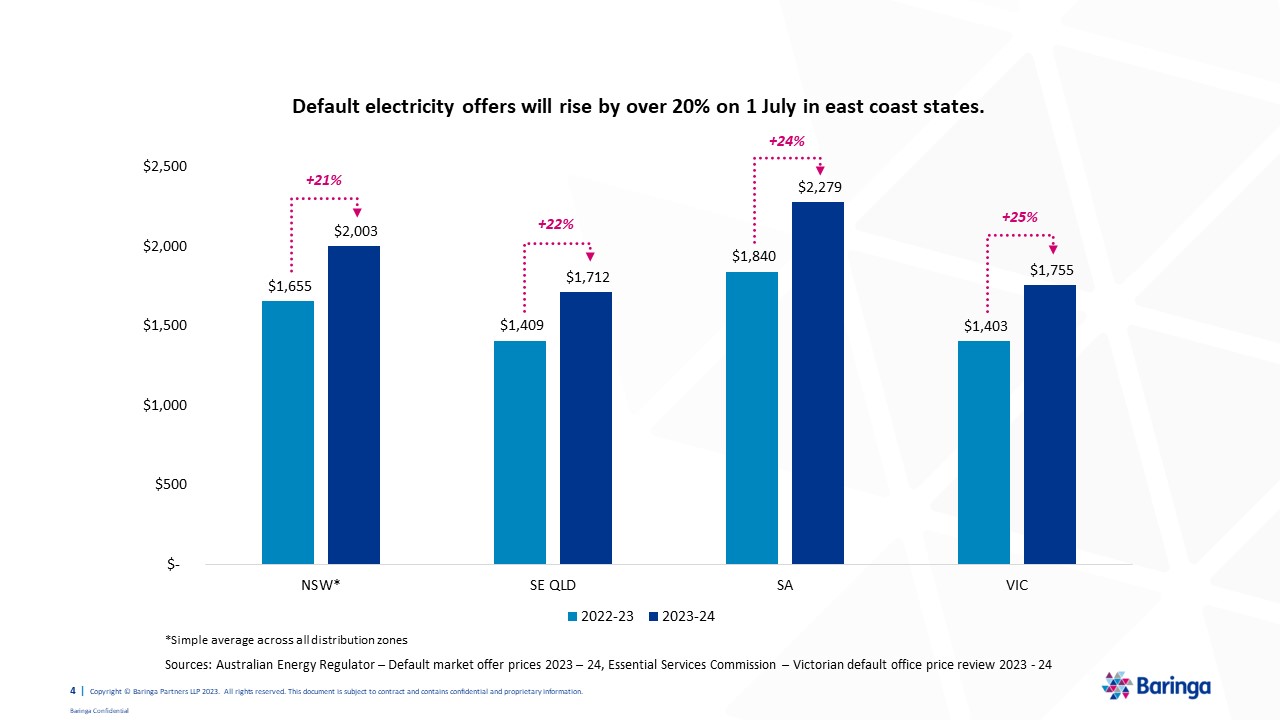

The energy affordability crisis that has been building in Australia will arrive on 1 July

Electricity spot prices experienced nothing short of a market earthquake in June 2022 driven by a range of market conditions – primarily the sharp increase in commodity prices due to Russia's invasion of Ukraine. Household and business energy bills were somewhat sheltered from this unprecedented volatility, but the ripples of energy bill rises will grow into a tidal wave when new default offers, confirmed on 25 May, take effect on 1 July. Record high default offer rises of 20-30% in the east coast states set the scene for an energy affordability crisis that needs to be tackled head-on by retailers.

Sources: Australian Energy Regulator – Default market offer prices 2023 – 24, Essential Services Commission – Victorian default office price review 2023 - 24

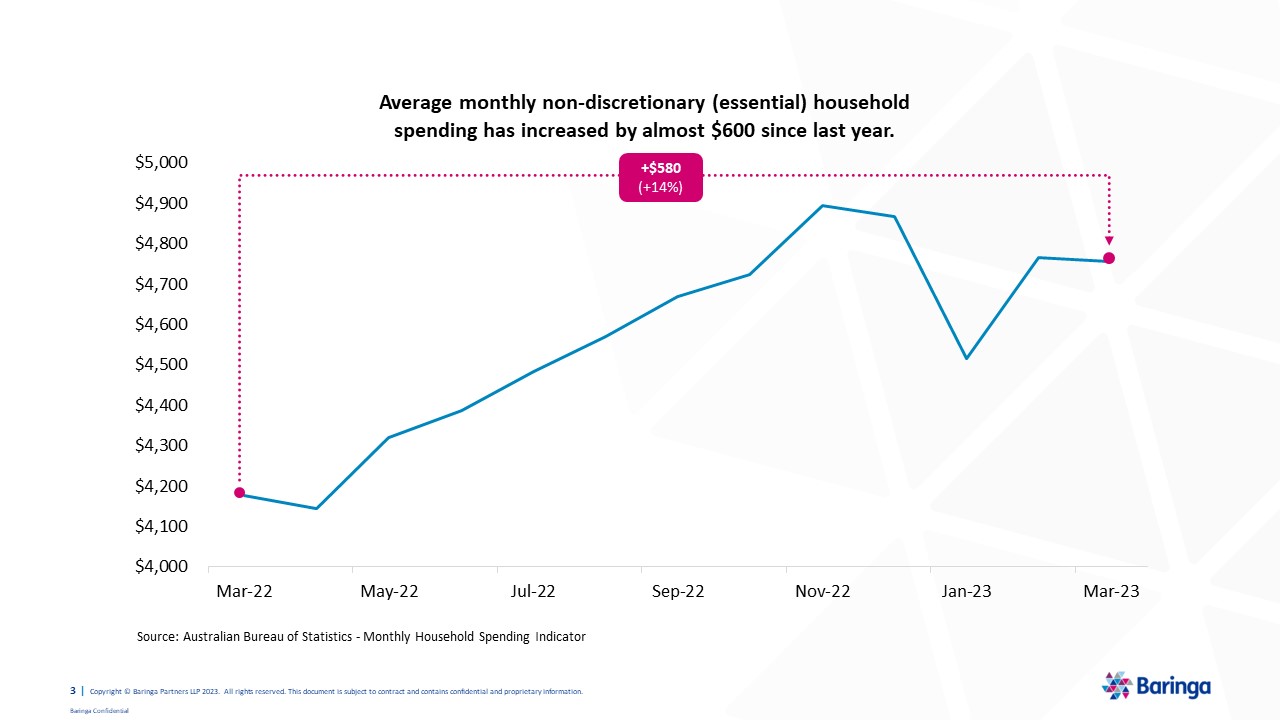

Bill hikes will add another layer of financial pressure to households that are already struggling

The compounding impact of steep inflation and higher interest rates is driving households to cut back, make everyday sacrifices and even go without essentials. Inflation has fallen marginally with latest ABS results showing a CPI inflation at 7.0%, down from 7.8% in the previous quarter, but none would contend that regular households are feeling the pinch any less. Debt servicing costs add fuel to the fire with mortgage repayments (and rental prices) rising quickly due to Australia's relatively high proportion of floating rate mortgages compared to other economies like the UK and the US. Those still hanging on to low fixed rates are likely to have to refinance into higher rates soon (what has been dubbed the 'mortgage cliff’). The net effect is an almost $600 monthly increase in average household outgoings for essentials compared to the same time in 2021, and a fall in real disposable incomes for the first time in over 30 years. The near-term economic outlook does not predict a significant positive change, either.

Source: Australian Bureau of Statistics - Monthly Household Spending Indicator

Energy consumers are expected to struggle more compared to last year even with government measures softening the blow

The government has been working to develop a non-inflationary intervention to help households and businesses since an energy bill relief plan was promised in December last year. The long-awaited budget from the Commonwealth clarifies the details – the Australian and state/territory governments will work together to provide $175 - $500 of credits directly on energy bills (depending on the jurisdiction) to eligible households in FY2023-24, and eligible small-to-medium businesses will also receive financial support. While the rebate will make a meaningful difference, other unyielding cost pressures will leave households with significantly less at the end of the month compared to last year.

The government's strategy to target payments at those with concession cards is a sensible one. Baringa's work with UK energy retailers clearly showed that people already facing difficult times were the hardest hit by price rises (discussed further below), and the government rebates were distributed more broadly. It also makes sense that in most jurisdictions, consumers do not need to apply to receive the bill rebates. We know that customers who are already overwhelmed with bills are focused on more immediate and essential things than stepping through hoops to apply for a bill credit.

Even with the targeting and automatic application of credits, the bill relief will be a life raft for some but just a straw for others.

Energy retailers will see the consequences in their debt books

There are two impacts that could be reflected in retailer book:

- Increasing number of indebted customers. Higher energy bills could push some over from just-making-it to struggling-to-get-by.

- Falling recovery rates. Customer capacity to pay will depart further from billed revenue, making all billed revenue 'riskier'.

These compounding effects saw debts grow by +75% in 12 months for some retailers in the UK. While the impacts are unlikely to be as drastic in Australia, retailers should still expect an unprecedented movement in their debt expenses.

Adopting a person-centred approach can help everyone better weather the storm

The coming changes will be difficult for all, but retailers can lessen the sting for customers and their business alike by helping customers stay on top of their bills.

Retailers need to look closely at both their processes and capabilities to mitigate debt risks while supporting customers. Many retailers already have strong foundations, but the step change in the level of customer vulnerability necessitates a re-assessment. Some of the top opportunities we have identified from our work with utilities are:

- Process: Find smarter ways to identify needs and connect customers to help earlier. Launching interventions before a customer falls too far into debt is critical for helping them stay above the waterline. Retailers should analyse the catalogue of customer pathways to ensure that they provide the right support at the right time. Funnelling customers through the appropriate routes is only possible if retailers use a sophisticated customer segmentation framework and deploy intelligent data processing to identify customers at risk.

- Capability: Develop targeted debt relief and affordability measures. Going beyond the regulated requirements of hardship programs and payment plans can demonstrate a retailer's willingness to put customers first. These initiatives could include matching customer payments 1:1 with debt relief to encourage repayment, or developing better communication materials to reach customers that have difficulty navigating the complexities of energy bills and rebates. Many retailers do this well already but should reconsider if the initiatives will keep up with the shift in customer vulnerability and capture the customers who are beginning to struggle in time.

- Capability: Prepare, invest in and support frontline staff. All retailers work hard to continuously improve frontline experience and prioritising changes that equip call centres with the tools to support customers in-need will be key. This is complex and customers will need to know what help they can get, whether it be the recently announced government package, other rebates or referrals to financial counsellors. Connect customers to external support – and possibly even assisting them to apply for that support – can be helpful for all. Importantly, retailers should also continue to invest in supporting their call centre staff who bear the brunt of tough phone calls with distressed customers.

To discuss how your energy retail business can identify and close the gaps in your credit management and affordability capabilities, please get in touch.

Related Insights

Bringing the industry together to support customers

We share an overview of the challenges, solutions and success factors highlighted by our clients and industry partners around financial vulnerability

Read more

Financial Vulnerability: how to be part of the solution

Businesses should prepare to support their customers in managing the pressure of household finances rising.

Read more