Discussions about sustainability, climate change, and environmental, social and governance (ESG) frequently lead to the same conclusion – the need for collective action. Indeed, partnership as the new leadership was a recurring theme at Davos this year.

In the first article, we outlined the challenge facing the aviation sector. In this article, we will explore the role of the supply chain and encourage the industry to accelerate the transition to sustainable aviation.

Reassuringly, the technology required to produce and use SAFs is available. We’ve seen Sustainable Aviation Fuel (SAF) blended with traditional jet fuel and trialled in existing aircrafts without the need to redesign the fleet fuselage or engine design. Despite this trial reducing emissions by up to 70-80%, overall uptake remains low.

To scale SAF infrastructure and usage, investment and collaboration across the Value Chain is required – from the oil & gas majors producing and the airlines buying the fuel, to the airports, regulators and investors impacting the industry landscape.

Breaking the deadlock between supply and demand

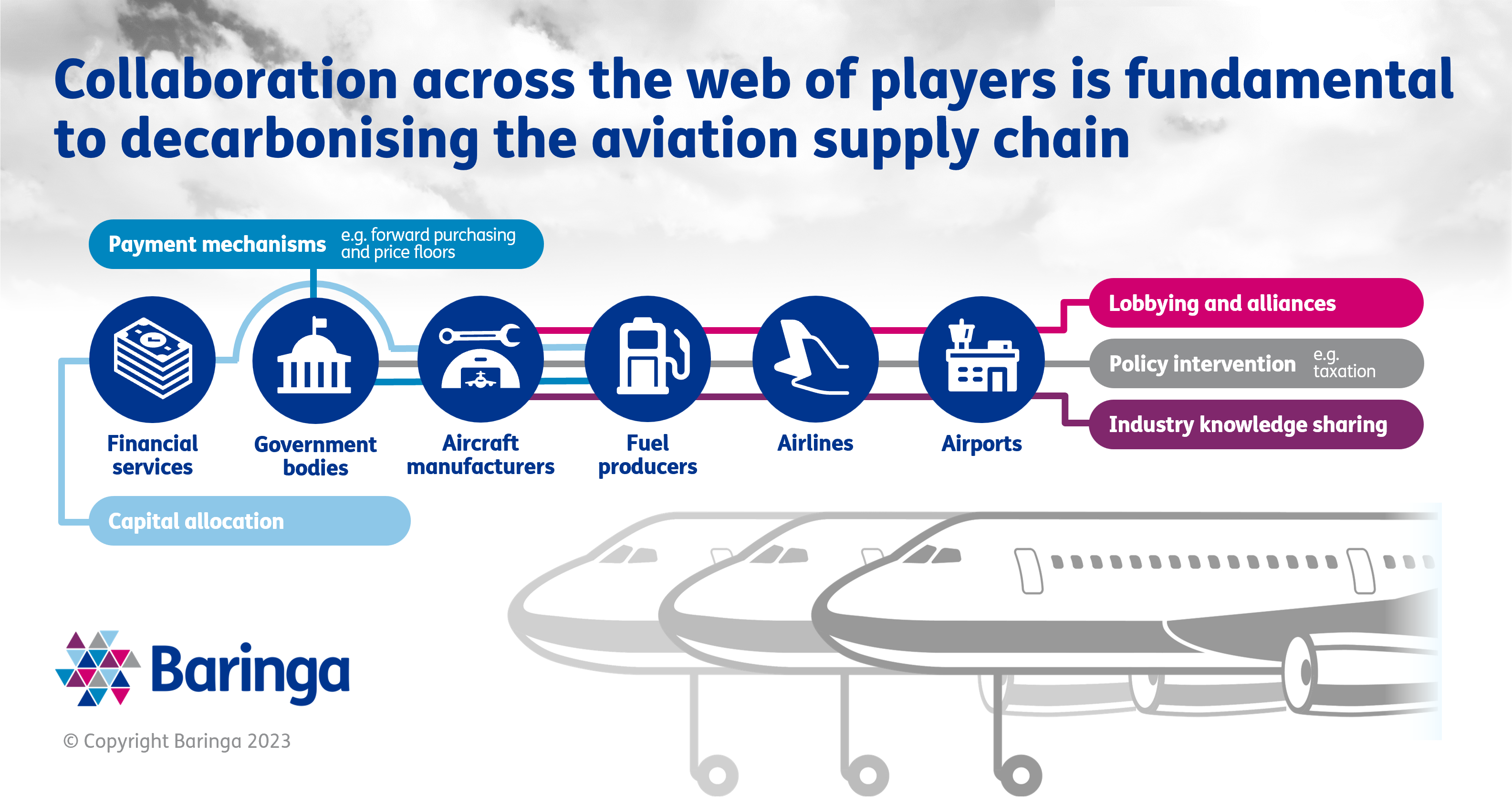

To understand why SAFs have not taken off yet, we need to assess the cards held by players across the aviation value chain. The value chain is a complex web of stakeholders, ranging from government bodies and financial services, to airlines, airports, fuel producers and aircraft manufacturers. Each player is at a different stage in their journey to Net Zero. Yet, where SAFs are concerned, they are collectively at an impasse.

On the supply side, the uncertainty of revenue and high upfront capital costs associated with SAF development is a barrier to scaling production. Ambiguity around topics, such as the true sustainability of feedstocks, creates uncertainty for investors considering capital allocation decisions in sustainable business, in turn avoiding the risk of stranded assets. Consequently, current levels of capital allocation into SAF projects is insufficient. This means that, whilst the SAF demand amongst airlines exists, the associated costs are still too high to secure predictable forward contracts.

As the urgency of the situation increases, so too does the need for infrastructure.

Without action and cross-industry collaboration, accountability will fall short between the ‘do-ers’ and the ‘enablers’, preventing the industry from achieving net zero.

Finding a fix: It is time for policy intervention

Policy intervention could be the catalyst to drive investors’ confidence in funding large-scale SAF projects. For example, upfront payments, forward purchasing and price floors would enable supply-side companies to increase production with guarantee of return on investment.

This policy intervention could drive increased demand for SAFs. With airlines operating on wafer thin margins, and the whole-life cost of SAFs being higher than that of traditional jet fuel, the option to pay a SAF premium poses a risk of revenue loss if not adopted by airlines globally. However, through levying additional taxes on the more polluting traditional fuel, governments could mitigate this threat to profit levels and the loss of competitive advantage by raising flight ticket prices at an industry-level.

For this to be effective, it is crucial that policy interventions are coordinated at an international level as SAFs would need to be available in both the departure and destination countries.

If successfully implemented, such measures would dismantle the barriers preventing widespread adoption of SAFs amongst airlines. This demand would drive financial institutions to invest in projects, accelerating the provision of high yield, low-cost SAFs.

Everyone has a part to play

Partnerships hold the key to this success. Stakeholder collaboration is crucial to boost both production and uptake of SAFs. Increased and faster adoption will be driven by policy intervention, and ensuring capital is accessible and affordable through financial incentives and fixtures. Economies of scale will drive down the overall cost of SAFs, while government-backed financial initiatives such as upfront payments, forward purchasing and price floors would give fuel manufacturers the confidence to increase production.

Throughout this shift, the sharing of knowledge, both within and cross-industry is not to be underestimated. Communication across the aviation value chain through alliances and peer events will raise the voice of the industry in lobbying for policy intervention.

Most importantly, everyone must act. From relatively small steps, like establishing or joining an alliance, to large-scale movements such as upfront payments, forward purchasing and price floors would enable supply-side companies to increase production with guarantee of return on investment. To achieve meaningful progress in cutting emissions and slowing down climate change, partnerships must become the new leadership.

To learn more about our work driving decarbonisation in the aviation industry, please get in touch with Megan Toon, Kristin Allan or Isabella Shortman.

Our Experts

Related Insights

Don’t dismiss dialogue. Why Competitive Dialogue should be explored for your next complex technology procurement and how to get it right

Competitive dialogue isn't just a procurement process; it's a strategic approach to engaging with bidders, validating solutions, and enabling value-for-money.

Read more

Making data an ally to project delivery decision-making

With the increasing pressure for the public sector to do more with less, Government need to unlock its potential and put data and analytics at the heart of project delivery excellence.

Read more

How far will the Chancellor’s productivity programme go towards unlocking a more effective public sector?

Details of the latest government productivity programme have been revealed – but now comes the hard work of implementation for departments and agencies. Lessons must be learnt from previous efficiency drives.

Read more

Solving the public sector productivity puzzle

Government departments are facing tight funding settlements – regardless of who forms the next government. This means driving productivity improvements will continue to be a core focus. The first step is fixing the flaws in how productivity is understood and measured.

Read moreRelated Case Studies

Building the UK’s critical Covid-19 Test & Trace infrastructure

How do we drive procurement success during the biggest global health crisis of the last century?

Read more

Bringing best practice to a major government department

We created measurable programme progress and raised the departments' credibility to deliver with ministers.

Read more

Shaping a government department’s net zero portfolio delivery approach

Achieving net zero emissions is one of the most pivotal and complex economy-wide transformations in UK government history. How do we measure progress and prioritise initiatives to make the biggest impact?

Read more

We designed the NHS Covid vaccine supply chain, putting patients at its centre

With Covid numbers rising, and first vaccines coming to market, the NHS needed an agile and resilient vaccine supply chain to deliver millions of jabs to the country.

Read more