In a world filled with extraordinary market conditions and increased complexity in the energy trading markets, making trading and business decisions using accurate, robust, and reliable models should be at the forefront of every organisation’s agenda.

Models and their outputs are used daily to make financial, strategic, and operational decisions. Firms' increasing reliance on models and scenario analysis to assess future risks, and the evolution of sophisticated modelling techniques highlight the need for sound model governance and effective model risk management frameworks. But the issue facing many organisations today is a fragmented approach to model management and a lack of synergy across functions to develop models that are independently validated prior to inception. This gives rise to model risk which has the potential to negatively impact multiple aspects of an organisation, from exposure calculations, through to position valuation and risk measurement.

Model risk can be defined as:

- The risk associated with using an incorrect valuation methodology and the exposure arising from reporting incorrect information.

- The risk associated with using unobservable (and possibly incorrect) calibration parameters in the valuation model.

Models are developed using several assumptions about the traded volumes, prices, and volatility. But the robustness of such models has been challenged by recent market stress. Assumptions made about the market 2 years ago would be very different to those made today. In the same way that markets evolve over time, models should also evolve to ensure they remain useful and accurate. This is done through ongoing model validation and robust model risk management frameworks.

What is model risk management and what does best practice look like?

Effective model risk management establishes ownership and accountability across the organisation to mitigate the risks of inadequate design, insufficient controls, and incorrect usage of models.

What are the components of an effective model risk framework?

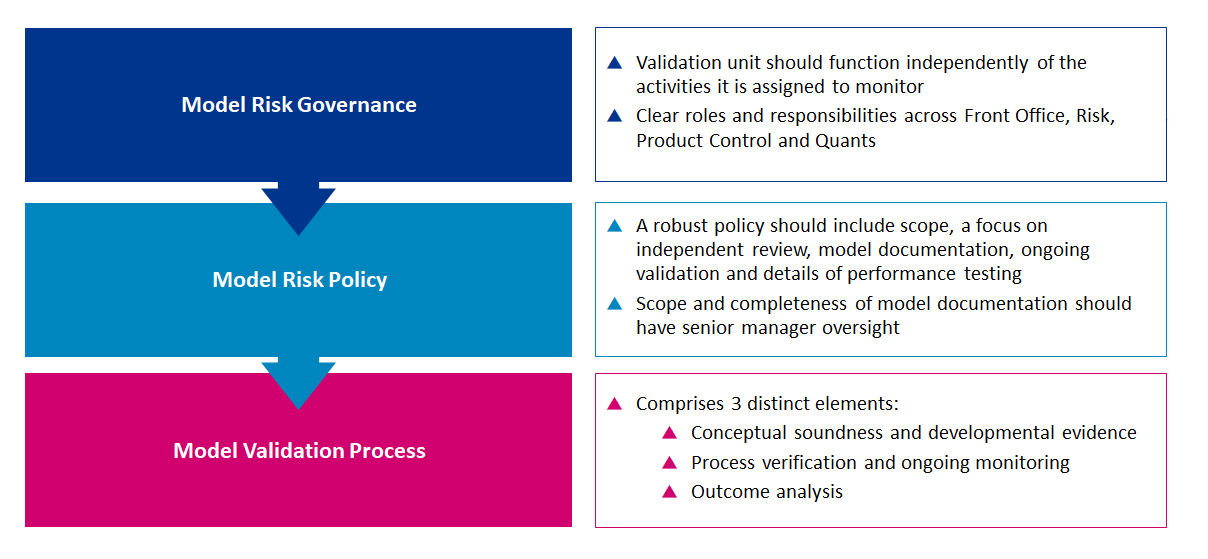

A robust model risk management framework should consist of the following three areas:

What role does model validation play?

Model outputs are inherently uncertain because they are simplifications of complex real-world systems and processes and based on a limited set of observations. To identify model weaknesses, the model validation process should include model performance testing prior to model deployment, at least once a year post deployment and whenever any alterations or amendments are made. The key components of model validation are as follows:

All models have limitations, however ensuring your models are still fit for purpose is critical in minimising model risk and subsequently financial loss. This responsibility sits across all 3 Lines of Defence (3LOD) and requires a collective effort to establish governance frameworks and accountability to manage and control the risks associated with the use of models.

In the face of volatile market conditions, inaction is not an option. At Baringa, we are working with CROs of energy trading companies to help them respond to this challenge by strengthening their risk frameworks and enhancing their risk monitoring and reporting systems. To discuss how we can support your business, contact our experts.

Our Experts

Related Insights

Commodities and energy trading video series

Join us as we delve into key areas that are shaping the trading industry

Read more

Navigating risk: insights into the complexities and challenges of LNG trading

We have highlighted some key challenges related to complexity of LNG trading which Risk Managers of trading organisations must deal with.

Read more

Digital transformation and decarbonisation in the energy sector

Energy leaders are using digital technologies and data to fast-track their journeys to decarbonisation.

Read more

Unveiling the cost of capital: navigating financial terrain in energy/commodity trading

In this article, we'll explore why cost awareness and transparency are important and provide some thoughts on cost of capital allocation.

Read more