In the past five years, many energy trading companies were fast to close PPA (Power Purchase Agreement) contracts to meet future supply of green energy production, moving away from conventional production towards the pursuit of sustainability goals. From the perspective of an energy trading company, managing a large renewables portfolio bears opportunities but also large risks. While having a renewables portfolio under subsidy has been common practice in the past, merchant contracting (e.g. fixed-price) bears new risks and a different set of challenges to the internal operating model. On top of the risks of a volatile, weather-dependent production pattern, an increasing number of PPAs are closed for a long-term tenor on a fixed price. In this context, making sure that risks are effectively monitored, re-evaluated on a regular basis and integrated into the client’s target operating model is of crucial importance.

A PPA valuation framework to enable better steering

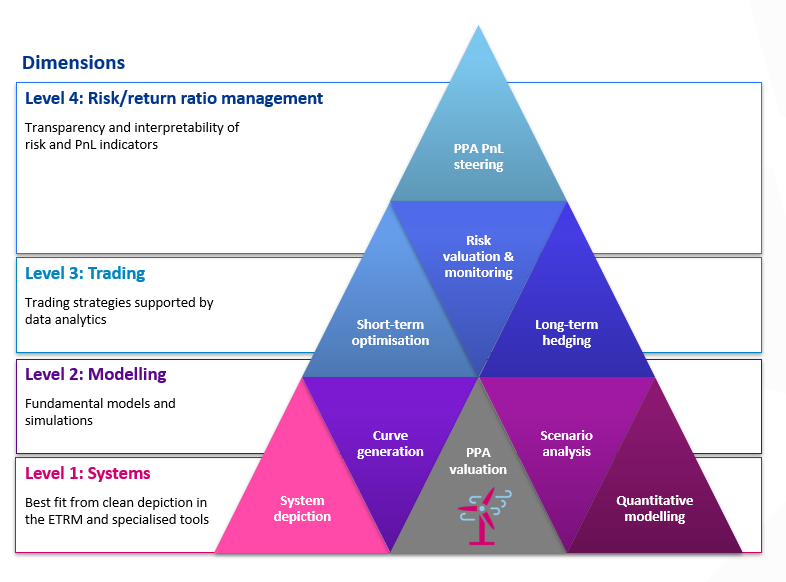

In the graphic below we provide a holistic view of the key elements you need to consider to successfully manage a PPA portfolio. In the framework we address four key dimensions:

1) The system

The IT layer that is used for PPA deal capture, depiction and valuation

2) The modelling

The quantitative PPA pricing, valuation and risk

3) The trading

The short- and long-term market operations to hedge and optimize your position

4) The risk/ return ratio management

The management of capital allocation and overall steering of the risk-return profile of the portfolio.

Managing a PPA portfolio requires an adequate interlock of all four key dimensions. At Baringa we assess the tools, processes, metrics and concepts highlighted within this framework to help trading firms to make considered risk-return decisions.

1. System: 4 considerations to make the right selection

Starting at the bottom of the graphic, firms need to select the right system to handle their PPA contracts. Here several criteria need to be considered. You’ll need to weight up the strengths of the system, as well as consider compatibility with your organisation´s target operating model and capabilities.

Organisations typically face two alternatives: a) mapping the PPAs in a traditional ETRM system or b) deploying them in a specialised software. Where is the valuation of PPAs done most effectively? How can all the operational processes such as dispatching, invoicing and nominations run through without hiccups? Is the existing ETRM able to meet all the particular requirements associated with PPAs or does it make sense to invest into specialised systems? To answer these questions and determine which system to use to handle PPAs, we have identified four key factors firms need to consider:

a) The complexity of price models in PPAs and the need for customization and business agility

The complexity of price models will have an impact on how PPAs need to be represented in the data model and how they can be captured in the deal entry screen. The risk model also needs to offer the right flexibility to handle the required payoff formulas for the PPA portfolio. A classic ETRM system might require higher customization effort and a longer period of time to implement new PPA structures since its core strength lies in standardized products, while a specialized tool made for the purpose of depicting non-standard PPA contracts, offers a higher degree of freedom and flexibility to add or adjust new contract structures.

b) The business’ existing system landscape and architecture

Here the question is if a central ETRM system already exists in the business and if the system landscape is following a more centralized or decentralized approach. An ETRM can offer an end-to-end handling of the trading life cycle, while a specialized tool is adding to the complexity of the system landscape, but also offering new functionalities.

c) Your requirements on trade validation, contract management workflow and governance

Deploying a specialized tool means having a more complex contract management process and data flow across multiple systems. This involves, for example, counterparty setup, trade validation and settlement. Here it is important to assess the future workflows and to make sure an integrated process can be established so that data governance requirements will be met.

d) The quantitative and developer capabilities of the business

The capabilities and resources available in the business need to match the required skills to maintain the system – be that a specialised tool or ETRM – and the embedded risk model, if you’re to realise its full potential and gain competitive advantage.

2) Modelling: Developing commercially viable pricing and staying competitive

Pricing PPAs effectively requires a solid understanding of the market and the economic outlook. Especially for contracts with long-term tenures, a fixed-term price should be carefully agreed on. How?

- Using fundamental models: Pricing decision are typically based on the outlook of current as well as forecasted market prices. However, the ability to forecast market prices effectively depends on the type of fundamental price forecast model as well as on data availability. Which factors determine the wholesale market price on the specific market? How are prices forecasted for the illiquid horizon (i.e. time horizon at which there is no trading activity on the exchange)? What data is needed to create a model that produces fair price forecasts? We work with clients, drawing on proprietary fundamental models to reflect market expectations and determine their impacts on the price of power.

- Understanding capture rates: Capture rates are vital to understand but what are they? Simply put, the capture rate is the value a specific renewable asset can ‘capture’ in the wholesale market i.e. a solar asset only generates revenue when the sun shines, whilst a wind asset only generates revenue when the wind blows. The revenue achieved by each asset can be compared to the baseload wholesale price and expressed as a ‘capture rate’. The capture rate will vary asset by asset based on technology type and location with fundamental drivers such as capacity build out rates, system demand and weather driving variability in capture rates in both long and short term horizons. Fundamental models are generally used to determine future capture rates.

- Pricing relevant risks: Pricing PPAs requires a strong fundamental basis to reflect the market outlook as well as the ability to understand correlated and uncorrelated volume-price risk. However, market risk is not the only risk to consider when pricing PPAs. Other risks to consider include system constraints, credit costs and liquidity costs (e.g. associated with hedging the exposure). Another factor that can be modelled into a larger PPA portfolio is the potential effect from portfolio diversification. What-if scenarios are a common approach towards investigating a set of price and portfolio effect constellations.

3) Trading: focus on hedging practices in the medium and long-term time horizon to continuously optimise your PPA portfolio.

Asset-backed trading in the context of PPAs will be different at each company and should be aligned with the overall risk-return appetite of your organisation. With volatile generation profiles, we recommend having a clear strategy for different time periods in order to actively manage and continually optimise your PPA portfolio. This reduces the risks of losing money in the situation of under-/overhedged volumes at or close to delivery. What does this look like?

- Invest in automation in short-term trading: Day Ahead/ Intraday optimisation strategies may be based on weather signals, fundamental models, algorithmic techniques and the integration of flexibilities via storage facilities - all of which can be automated. Automation is expected to reduce the amount of human-based errors and manual effort required, while increasing the potential to execute faster and on a more granular level where small changes in exposures are detected and can be put into the market.

- Use signals in medium-term trading: Hedging activities may need a set of signals or agreed on market price changes that can be defined as triggers for action. These triggers may stem from market volatility indicators, the PPA’s sensitivity towards price changes (or simply the asset’s stand-alone Mark-to-Market) or market liquidity indicators.

- Design a roll-forward strategy for illiquid trading horizons: For long-term PPAs, portfolio managers typically can’t hedge the last years as the markets are too illiquid to allow for hedging. Instead, it is common for volumes to be hedged using proxy hedges in the nearer (liquid) time horizons, and then continuously rolled forward as the time periods become more liquidly traded in the market. We recommend using trading metrics such as price signals and market liquidity thresholds to help finding the right moment to roll forward. The cost of a stack and roll strategy in terms of collateral also needs to be considered carefully and traded off against the level of market risk held. As an alternative, many traders look to Corporate PPAs to help manage the long term price risk in return for higher credit risk exposure.

4) Risk/ Return Ratio Management: Effective steering is enabled when associated risks and potential gains are transparent.

An essential part of effectively steering a PPA portfolio implies getting the valuation right as we previously highlighted. However, the day by day (Mark-to-Market) valuation provides a “best-of” picture and needs to be enriched by alternative scenarios such as worst case results and estimated losses. We highlight three aspects that are particularly challenging when it comes to managing the risks of PPAs.

- Simulating volumetric-price risks: Depending on the contractual parameters (e.g. price components, shape of profile or references to price indices), the inherent risk can best be modelled using a Profit-at-Risk/ Earnings-at-Risk or Simulation Models instead of the more common models in trading (e.g Value-at-Risk). The crucial part is to create understanding behind the risk metric’s interpretation and to align it to management steering decisions. An alternative, or supplementary, approach to the stochastic model would be use of scenario analysis, ideally using a fundamental model which explicitly models volume/price risk. Benefits of using scenarios within a stress testing framework is the ability to communicate risk via a coherent ‘narrative’ to senior Executive in the business.

- Adopting KPIs that indicate capital deployment: PPAs can be capital intense – whether it’s the liquidity costs that arise from hedging activities or credit costs to provide collateral. The margin and liquidity impacts can be significant in volatile markets. We recommend choosing KPIs specifically to measure the capital utilisation when taking PPA decisions.

- Being aware of accounting and reporting effects: Transparency must also exist around the implications on (internal) reporting and financial statements. Depending on how the accounting standards are applied, the effect on the balance sheets may be large, and thus effects are typically measured and monitored in daily reports.

PPAs can open up new opportunities for trading firms, but they need to be meticulously managed to drive value. Developing the right target operating model, so you have the right set of tools, processes and methods to get transparency on the risks and returns of their portfolio is crucial. We support organizations to do this by supporting system selections for PPA portfolios, pricing models, KPI reporting content, trading strategies or risk models for a PPA portfolio. To discuss how we can support the development of your operating model for PPA portfolios, please get in touch.

Our Experts

Related Insights

Commodities and energy trading video series

Join us as we delve into key areas that are shaping the trading industry

Read more

Navigating risk: insights into the complexities and challenges of LNG trading

We have highlighted some key challenges related to complexity of LNG trading which Risk Managers of trading organisations must deal with.

Read more

Digital transformation and decarbonisation in the energy sector

Energy leaders are using digital technologies and data to fast-track their journeys to decarbonisation.

Read more

Unveiling the cost of capital: navigating financial terrain in energy/commodity trading

In this article, we'll explore why cost awareness and transparency are important and provide some thoughts on cost of capital allocation.

Read more